In his April editorial Solving the Energy Trilemma, the president of the Australian Academy of Technology and Engineering states that small modular reactors may change the equation on nuclear energy economics and, “if that turned out to be the case, Australia would lag behind the rest of the world”, because Australia prohibits it outright.

He goes on to say,

Suppliers of variable renewable electricity generated from the sun and wind need to ensure 24-hour supply through the use of energy storage. While there has been a lot of noise in the media about whether renewables can achieve continuous supply, the answer is very clearly that they can. It will require storage but the massive investments going into batteries and other grid storage solutions… give us confidence that we shall be able to meet this need.

Courtesy of futurENERGY

So, it’s definitely time for a good old-fashioned comparison of climate-friendly energy sources. This has been made possible by anticipated sizes, costs and operating parameters reported in online media and the literature. More fundamentally, the energy sources are solar photovoltaic with seawater pumped hydro, and nuclear energy, both effectively dispatchable and therefore hypothetically directly comparable.

In August 2014 the combined Valhalla Cielos de Tarapacá and Espejo de Tarapacá project in Chile was announced. It will supply the Chilean grid by day with solar and by night from hydro, using seawater stored on a clifftop reservoir, pumped there with excess solar electricity.

PV capacity………………………………………………..600 MW

Annual generation………………………………………1,800 GWh

Average daily generation……………………………..4.93 GWh

Average capacity factor……………………………….34%

Land area…………………………………………………..1,570 hectares

Expected cost…………………………………………….$900 million USD

PHS power capacity……………………………………300 MW

Max. input energy………………………………………2.28 GWh

Max. output energy…………………………………….1.75 GWh

Round-trip efficiency………………………………….76%

Duration at 300 MW output………………………..5.8 hours

Ave. output supplying for approx. 16 hours……….109 MW

Land area…………………………………………………..374 hectares

Expected cost…………………………………………….$400 million USD

Combined average annual capacity factor

after max. daily charging and discharging*……….31%

Combined cost……………………………………………$1.3 billion USD

Combined land area…………………………………….1,945 hectares

Expected commissioning date………………………June 2020

*This capacity factor is estimated from the average daily PV output, taking into account the maximum energy first stored, then released from the reservoir, subject to the reported round-trip efficiency.

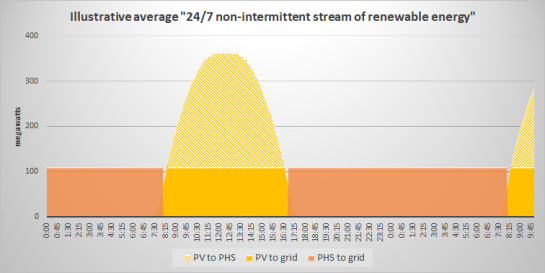

Crucially, this is billed as 24/7 supply in arguably the world’s most favourable location for this combination of technologies. It will be built at about 20.7 degrees south latitude. The Broken Hill solar farm is at 32 degrees south, and using a random full-day’s 5 minute output data as a proxy, a hypothetical “average day operation” of Valhala’s project can be reasonably pictured. This is also important as solar plus pumped hydro is being pursued for Australian electricity supply.

Pumped hydro is the most mature form of grid-scale storage, although it can be argued there is limited experience with seawater pumping. The unique, universally cited Yanbaru facility in Okinawa (substantially smaller than Valhalla’s project) was decomissioned after 17 years. However, storage capacity is not generation capacity. Where the former is added to support the latter, it effectively increases the cost of generation without adding any further capacity. What is fundamentally changed is the dispatchable value of the generation. This has already been stated as being directed toward “24/7 supply”, often thought of a baseload.

In November 2017 Canadian nuclear energy start-up company Terrestrial Energy concluded the first phase of the pre-licensing vendor design review after several succesful rounds of capital raising, with the potential for building a prototype at the Chalk River Labs site. In March 2018 the company signed an MOU with Idaho National Labs regarding building another reactor unit at that site. This is a molten salt reactor design, the IMSR®, which features liquid fuel and intrinsically passive operation based around gravity and convection.

The company’s key commercial claim is:

IMSR power plants are a low cost clean energy alternative to fossil fuel combustion and they can be deployed in the 2020s.

A recent article in Annals of Nuclear Energy, along with other presentations, provided some specifications.

IMSR capacity………………………………………………..291 MW

Annual generation………………………………………….2,343 GWh

Typical daily generation………………………………….6.98 GWh

Average capacity factor……………………………………92%

Land area………………………………………………………6.8 hectares

Expected cost…………………………………………………$1.08 billion USD

Expected commissioning date……………………………after 2026

The major precursor to this reactor design development effort was Oak Ridge’s MSRE in the 1960s. Terrestrial Energy is only one of dozens of companies planning such a design.

Courtesy of Terrestrial Energy

The emergency shutdown capabilities are incorporated directly into the design of the IMSR vessel and building. By operating as a liquid at high temperature, shutdown intrinsically leads to cooling of fuel instead of overheating. By operating at close to atmospheric pressure, no driving force exists to expel any material from the power plant building. The homogenous nature of the fuel salt allows a six-fold higher efficiency utilisation of uranium than conventional reactors.

The estimated cost listed above is the literature overnight cost (ca. $0.83 billion) plus 30% financing on a five year project as described by the World Nuclear Association.

All else being equal, the Valhalla project will take just about 6 years to come online, while the 291 MW IMSR is more than 8 years from commercial readiness. In total, the former will require 286 times the land area of the latter, and as the IMSR is intended for factory production in the manner of commercial aircraft, with 4-year construction cycles, it has the potential for superior deployability.

To illustrate the land footprint aspect, the conventional Barakah nuclear power project in the UAE is sited on a coast moderately similar to the ocean-bounded Atacama desert. (The most dramatic difference is the absence of a 600 metre cliff – such geography isn’t necessarily common.) By 2020 it will feature four operational South Korean APR-1400 reactors.

Plant capacity……………………………………………………5,360 MW

Annual generation……………………………………………..42,260 GWh

Average capacity factor………………………………………90%

Land area………………………………………………………….8 hectares approx.

Final cost………………………………………………………….$6.1 billion USD per reactor

To “match” the output of one Barakah unit, Valhalla would hypothetically need to build 6.6 PV+PHS projects, requiring nearly 13 thousand hectares (over 1,600 times Barakah’s footprint) at a cost of $8.5 billion USD.

FURTHER COMPARISONS

Plant lifespan (years):

Photovoltaic Solar………………………………………25–30

Seawater Pumped Hydro………………………………17

Molten Salt Nuclear……………………………………..60

We are yet to see what will happen at the end of “the industry standard life span” for solar, or how long hydro involving seawater should economically operate for. Terrestrial Energy has indicated a plant lifespan which involves regular 7 year replacement of reactor core units (doubling as secure used fuel storage). The original Molten Salt Reactor Experiment operated for more than 4 years at Oak Ridge National Labs until funding arrangements abruptly changed. Consequently, these figures are only included for interest’s sake.

There are several other parameters which would be valuable to compare, namely the discreet material weight-requirements per TWh, the energy returned on invested, the comprehensive life-cycle GHG emissions, and the levelised volumes of other life-cycle by-products. Values for all of these depend substantially on operating assumptions and the rigour of the associated research. Robust values for both renewable energy/storage systems and advanced nuclear are not readily or publicly available, but will become increasingly important if national policies regarding clean and climate-friendly energy are to be comprehensively, scientifically informed.

There are several other parameters which would be valuable to compare, namely the discreet material weight-requirements per TWh, the energy returned on invested, the comprehensive life-cycle GHG emissions, and the levelised volumes of other life-cycle by-products. Values for all of these depend substantially on operating assumptions and the rigour of the associated research. Robust values for both renewable energy/storage systems and advanced nuclear are not readily or publicly available, but will become increasingly important if national policies regarding clean and climate-friendly energy are to be comprehensively, scientifically informed.